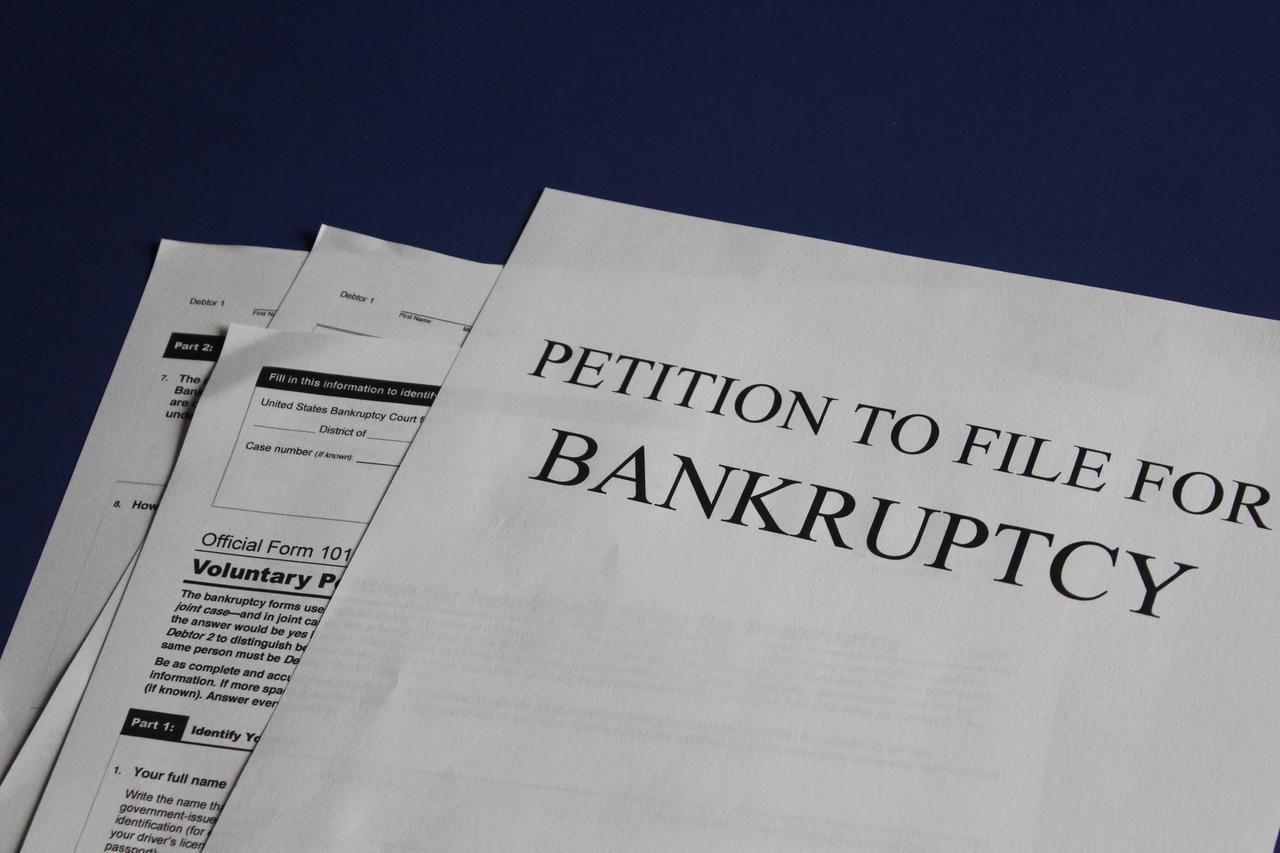

Common bankruptcy questions answered

For those considering bankruptcy, it’s a stressful time marked by uncertainty and filled with questions. While bankruptcy can feel fraught, thousands of people file each year and rebuild their lives debt-free. The early bankruptcy stages are overwhelming, but a qualified bankruptcy attorney can guide debtors through the legal maze with compassion. Bankruptcy isn’t a hasty financial decision. So, we’re answering the top bankruptcy questions to offer greater insight and clarity around chapter 7 and chapter 13 filings.

What does filing for bankruptcy mean?

The fundamental goal of bankruptcy is to provide relief to debtors from substantial and burdensome debt. Think of it as a fresh start in a new life without the constant pressure of owing multiple creditors money. There are six kinds of bankruptcy, organized by chapter. For most people, only Chapter 7 and Chapter 13 apply.

- Chapter 7: Liquidation. Places an automatic temporary stay on current debts and wipes away unsecured debts. However, it has a long-lasting negative impact on a credit report. The debtor may have to sell their property to repay creditors.

- Chapter 13: Adjustments. The debtor proposes a plan for repaying debts over three to five years. The court won’t sell property to satisfy outstanding debts, and it may discharge unsecured debts at the end of the repayment plan.

What happens after I file for bankruptcy?

For debtors facing foreclosure on their home, wage garnishment, or repossession of a vehicle, bankruptcy will prevent further action taken against them. What happens next depends on if the filer opted for Chapter 7 or Chapter 13. An experienced bankruptcy attorney can offer insight and guidance for those uncertain about the best option for their debt.

Will I lose my property?

This is a common bankruptcy question that depends on the type of bankruptcy. Chapter 7, often called liquidation, requires the filer to sell off some of their assets to satisfy their debts. Depending on where they live, those assets may or may not include their home, car, and retirement accounts.

With Chapter 11, the court doesn’t require filers to sell any property. The court reorganizes their debts into more manageable payments for a set amount of time–usually three to five years. At the end of that time, unsecured debt may be discharged.

What happens to my credit if I file bankruptcy?

Unfortunately, bankruptcy will have a negative impact on a filer’s credit score. It signals to future creditors that a person was unable to pay back their debts. Again, the bankruptcy type makes a difference in the effects on a credit report.

- Chapter 7: stays on a credit report for up to 10 years.

- Chapter 13: remains on a credit report for up to 7 years.

Despite this, filing for bankruptcy doesn’t forever doom the filer’s credit score. Credit reporting bureaus weight newer information. With improved borrowing happens, on-time payments, and by paying more than the minimum, filers can raise their credit score post-bankruptcy.

Can I file for bankruptcy a second time?

Everyone hopes for a fresh start with manageable debt following bankruptcy, but life is unpredictable. Established time limits prevent back-to-back filings.

- Chapter 7: Eight years between two Chapter 7 filings.

- Chapter 13: Two years between two Chapter 13 filings.

- Chapter 7 after Chapter 13: Six years.

- Chapter 13 after Chapter 7: Four years.

A knowledgeable attorney can provide more insight into repeated filings.

Reach out to a Flint, MI bankruptcy attorney today

Chances are, you have the same bankruptcy questions and anxieties as others in your position. An experienced bankruptcy attorney with a proven record of success can guide you through the bankruptcy process. Call or contact our Flint, MI or Corunna, MI offices today to learn if Chapter 7 or Chapter 11 bankruptcy is right for you.